Gold Price History in India (1964–2025) | Forecast for 2026–27, Investment Tips & Trends

💰 The Giant Gold Blog: From Rs.63 in 1964 to Rs.89,450 in 2025 & Beyond

📍 Introduction: India’s Everlasting Love for Gold

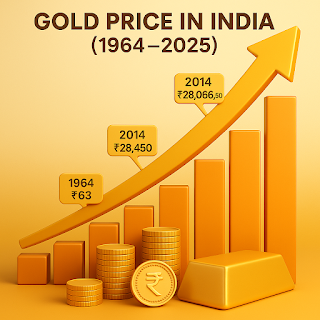

Gold is more than a commodity in India — it’s a symbol of wealth, tradition, and trust. For generations, families have passed on gold not just as jewellery, but as legacy and financial security. With time, its monetary value has skyrocketed, from a mere ₹63.25 in 1964 to an astounding ₹89,450 in 2025 (June). This journey not only reflects India's emotional connection with gold but also shows its unwavering strength as a long-term investment.

This blog offers you an in-depth look into:

- 60+ years of gold price history

- What drives gold prices

- Predictions for 2026 and 2027

- Smart ways to invest in gold in modern times

📊 Historical Gold Price in India (1964 – 2025)

Year Price (24K/10g) Year Price (24K/10g)

1964 ₹63.25 1990 ₹3,200.00

1965 ₹71.75 1991 ₹3,466.00

1966 ₹83.75 1992 ₹4,334.00

1967 ₹102.50 1993 ₹4,140.00

1968 ₹162.00 1994 ₹4,598.00

1969 ₹176.00 1995 ₹4,680.00

1970 ₹184.00 1996 ₹5,160.00

1971 ₹193.00 1997 ₹4,725.00

1972 ₹202.00 1998 ₹4,045.00

1973 ₹278.50 1999 ₹4,234.00

1974 ₹506.00 2000 ₹4,400.00

1975 ₹540.00 2001 ₹4,300.00

1976 ₹432.00 2002 ₹4,990.00

1977 ₹486.00 2003 ₹5,600.00

1978 ₹685.00 2004 ₹5,850.00

1979 ₹937.00 2005 ₹7,000.00

1980 ₹1,330.00 2007 ₹10,800.00

1981 ₹1,670.00 2008 ₹12,500.00

1982 ₹1,645.00 2009 ₹14,500.00

1983 ₹1,800.00 2010 ₹18,500.00

1984 ₹1,970.00 2011 ₹26,400.00

1985 ₹2,130.00 2012 ₹31,050.00

1986 ₹2,140.00 2013 ₹29,600.00

1987 ₹2,570.00 2014 ₹28,006.50

1988 ₹3,130.00 2015 ₹26,343.50

1989 ₹3,140.00 2016 ₹28,623.50

2017 ₹29,667.50

2018 ₹31,438.00

2019 ₹35,220.00

2020 ₹48,651.00

2021 ₹48,720.00

2022 ₹52,670.00

2023 ₹65,330.00

2024 ₹77,913.00

2025 ₹89,450.00

🔮 Price Prediction: 2026 & 2027

Year Estimated Price (24K/10g) Key Factors

2026 ₹103,000 – ₹1,10,000 Rising inflation, demand from central banks, weak rupee

2027 ₹1,10,000 – ₹1,25,000 Geopolitical tensions,reduced gold mining, digital gold push

⚠️ Note: Forecasts depend on macroeconomic conditions and global stability.

🤔 Why Do Gold Prices Rise?

- ⛈️ Inflation: Gold preserves purchasing power.

- 🌎 Global Instability: Wars, pandemics, and crises increase demand.

- 💵 Rupee vs Dollar: A weak rupee makes imported gold costlier.

- 🏦 Central Bank Buying: Bulk buying increases market prices.

- 🎁 Festival Demand: Demand peaks during Akshaya Tritiya, Diwali, weddings.

- 🏧 Interest Rates: Lower rates push people to non-interest assets like gold.

🌟 Should You Invest in Gold Now?

✅ Pros:

- Trusted inflation hedge

- Easy to liquidate

- Good diversification tool

- Cultural and emotional value

❌ Cons:

- No recurring income

- Short-term volatility

- Physical gold involves storage and making charges

🚀 Modern Ways to Invest in Gold

Type Feature Ideal For

Sovereign Gold Bonds (SGBs) 2.5% annual interest + capital gains; 8-year maturity Long-term investors

Gold ETFs/Mutual Funds Easy online trade; no physical gold Market-savvy investors

Digital Gold Buy for as low as ₹1 First-time or small-ticket investors

Jewellery/Coins/Bars Tangible; emotional Gifting, weddings, tradition

💡 Tip:

Invest through SIP in SGBs or ETFs to average cost over time.

🔹 Final Verdict: Is Gold Still Golden?

Absolutely. Gold has proven its worth across generations. While it shouldn’t be your only investment, a 5-15% allocation in your portfolio can balance risk and preserve wealth.

The next few years will likely see gold cross ₹1 lakh per 10g, making now a good time to enter, but smartly and gradually.

📆 Summary

- From ₹63 in 1964 to ₹89,450 in 2025

- Predicted to cross ₹1,20,000 by 2027

- Driven by inflation, demand, and global risk

- Invest using SGBs, ETFs, or digital gold for safety

Comments

Post a Comment